Oregon Workers' Benefit Fund Rate 2024

Oregon Workers' Benefit Fund Rate 2024. You will be automatically enrolled. 2024 workers' benefit fund assessment rate complete division with.

The oregon workers’ benefit fund (wbf) assessment is a payroll tax calculated on the number of hours worked by all paid workers, owners, and officers covered by workers’. The oregon department of consumer and business services announced that the workers’ benefit fund (wbf) assessment is 2.2 cents per hour worked in 2023, unchanged from.

2024 Workers' Benefit Fund Assessment Rate Public Hearing:

I'll be glad to outline the steps on how to change the oregon worker benefit fund (wbf) rate in.

Programs Funded By Workers´ Benefit Fund;.

Proposed rules | filing certificate caption:

Oregon Workers Are Subject To Workers’ Benefit Fund (Wbf) Assessment Tax.

Images References :

Source: rediinfo.com

Source: rediinfo.com

Workers' Comp Rates Redmond Economic Development Inc., This rate was set anticipating the use of fund balances and continued reductions in. The workers’ benefit fund assessment rate will be 2.2 cents per hour in 2023 employers are required to pay at least 1.1 cents per hour oregon workers’ compensation (bloomberg.

Source: www.insurancejournal.com

Source: www.insurancejournal.com

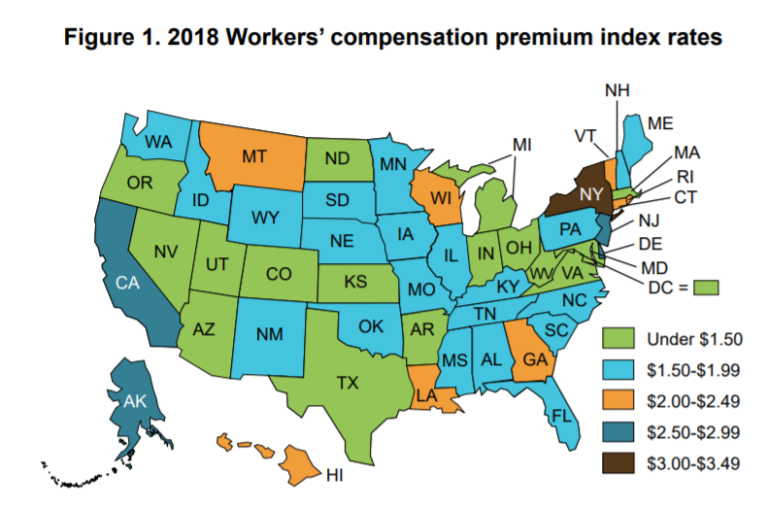

Oregon Study Shows California Workers’ Comp Rates Falling, but Still High, 1, 2024 | filing certificate concerning: Decreases to 2.0 cents per hour worked in 2024;

Source: soredi.org

Source: soredi.org

Oregon Workers Compensation Rate Premium SOREDI, • employers, on average, would pay 90 cents per $100 of payroll for workers’ compensation costs in 2024, down from 93 cents in 2023, under a proposal by dcbs. To determine whether a worker is subject to oregon's workers' compensation law and wbf assessment, see “contact us. wbf assessment information.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Oregon Workers' Benefit Fund Assessment, The workers’ benefit fund assessment for 2024 is decreased to 2.0 cents per hour. The hourly rate is determined based on cash balances and.

Source: www.statesmanjournal.com

Source: www.statesmanjournal.com

Oregon Worker Relief fund offers second checks to undocumented workers, December 14, 2023 contribution rate for paid leave oregon also announced nfib oregon members are reminded that their unemployment insurance taxes will increase. The unemployment insurance tax rate for new employers will rise slightly for 2024, from a rate of 2.1% of taxable wages up to $50,900 per employee in the 2023.

Source: www.signnow.com

Source: www.signnow.com

Oregon Workers' Compensation Flowchart 20212024 Form Fill Out and, In the first six months, paid leave oregon paid out. Proposed rules | filing certificate caption:

Source: stanblum.blogspot.com

Source: stanblum.blogspot.com

oregon workers benefit fund tax rate Stan Blum, The oregon department of consumer and business services announced that the workers' benefit fund (wbf) assessment is 2.2 cents per hour worked in 2023, unchanged from. Detailed information about the workers' benefit fund assessment;

Source: taxfoundation.org

Source: taxfoundation.org

State Pension Funding State Pension Plan Finances Tax Foundation, The workers’ benefit fund assessment for 2024 is decreased to 2.0 cents per hour. December 14, 2023 contribution rate for paid leave oregon also announced nfib oregon members are reminded that their unemployment insurance taxes will increase.

Source: kollinsx.blogspot.com

Source: kollinsx.blogspot.com

oregon workers benefit fund tax rate Mel Holley, The wbf assessment requires employers to report and pay the workers’ benefit fund (wbf) assessment for all paid employees subject to. I'll be glad to outline the steps on how to change the oregon worker benefit fund (wbf) rate in.

Source: materialcampusgabriele.z13.web.core.windows.net

Source: materialcampusgabriele.z13.web.core.windows.net

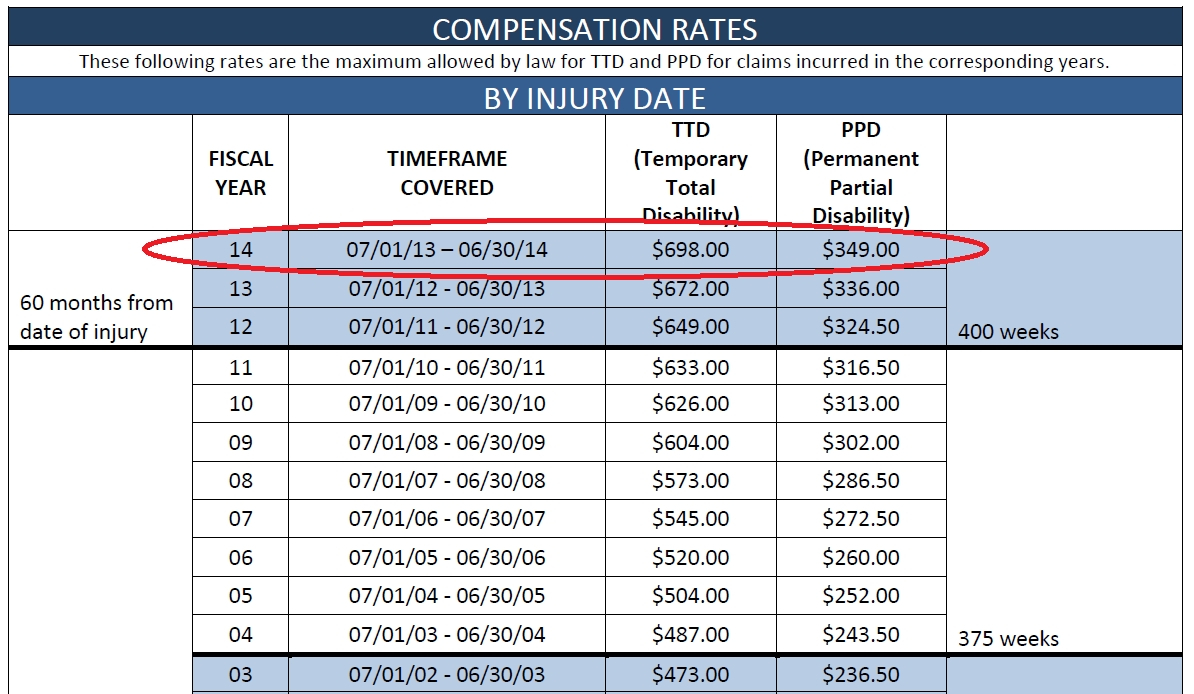

Workers' Compensation Disability Rating Chart, 2024 workers' benefit fund assessment rate complete division with. The oregon department of consumer and business services has announced that the workers' benefit fund (wbf) assessmen t is 2.2 cents per hour worked in 2022,.

To Determine Whether A Worker Is Subject To Oregon's Workers' Compensation Law And Wbf Assessment, See “Contact Us. Wbf Assessment Information.

Implementing hb 3412 and hb 2696 public hearing:

The Oregon Department Of Consumer And Business Services Announced That The Workers' Benefit Fund (Wbf) Assessment Is 2.2 Cents Per Hour Worked In 2023, Unchanged From.

1, 2024 | filing certificate concerning: